Wage and hour overtime calculation

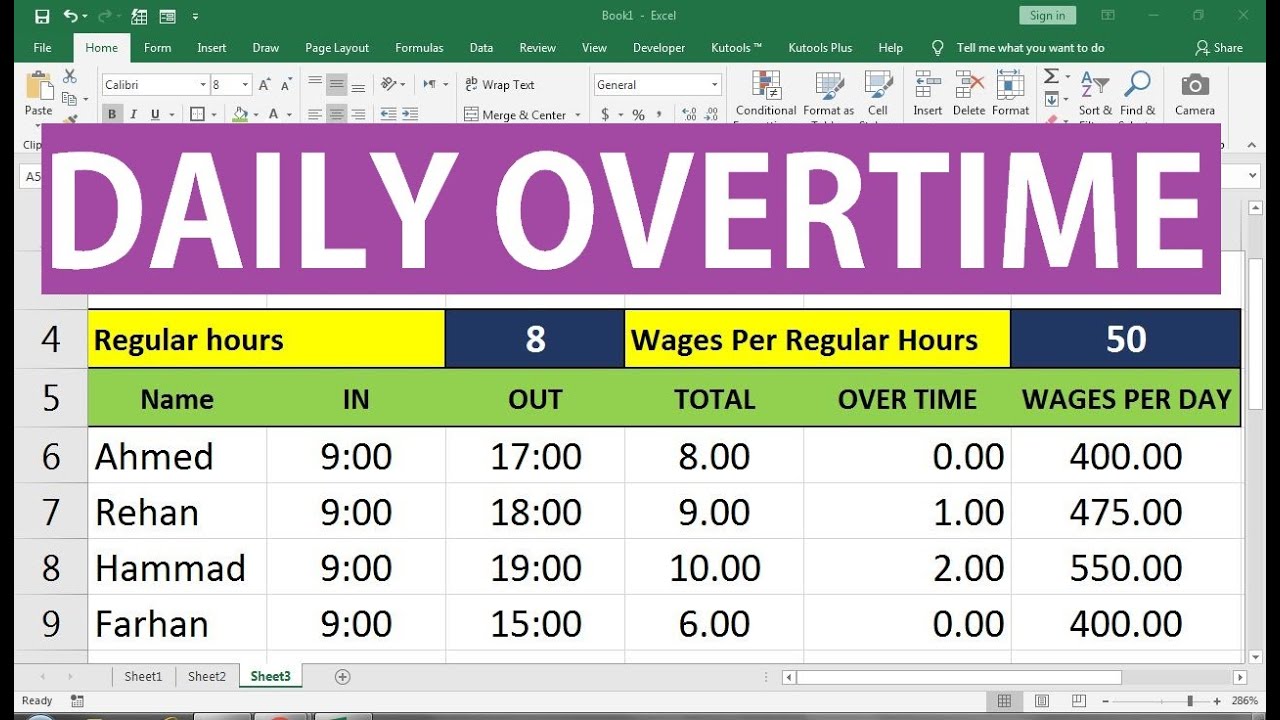

Users Who Switch To Our Software Report More Accurate Time Tracking. 500 straight-time pay 50 overtime pay 550.

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

The amount of money you are paid each hour before tax.

. For more information about COMPS coverage contact the Division at 303-318-8441. Regular Pay per Period RP Regular Hourly Pay Rate Standard Work Week Overtime Pay Rate OTR Regular Hourly Pay Rate Overtime Multiplier. Wage and Hour Law Overtime Overtime Calculations Overtime Calculations The following calculation examples assume the employee is non-exempt from overtime requirements of the Colorado Overtime and Minimum Pay Standards Order COMPS Order 38.

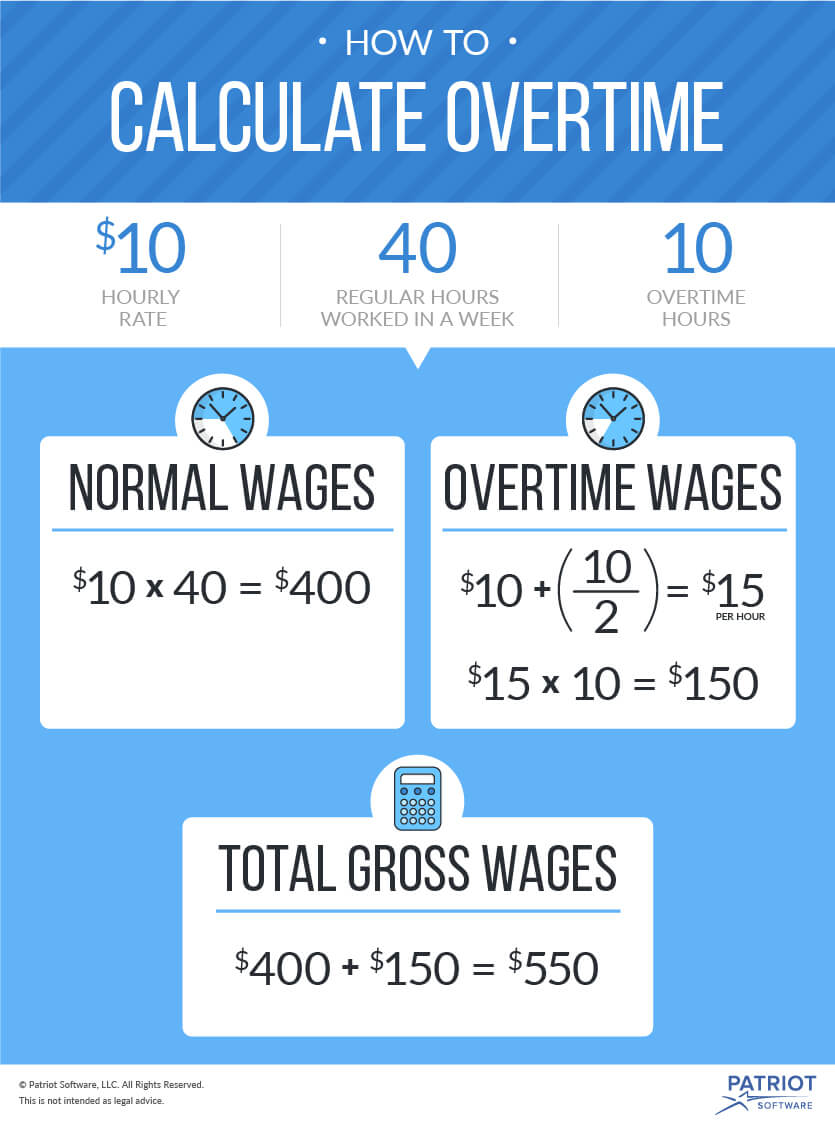

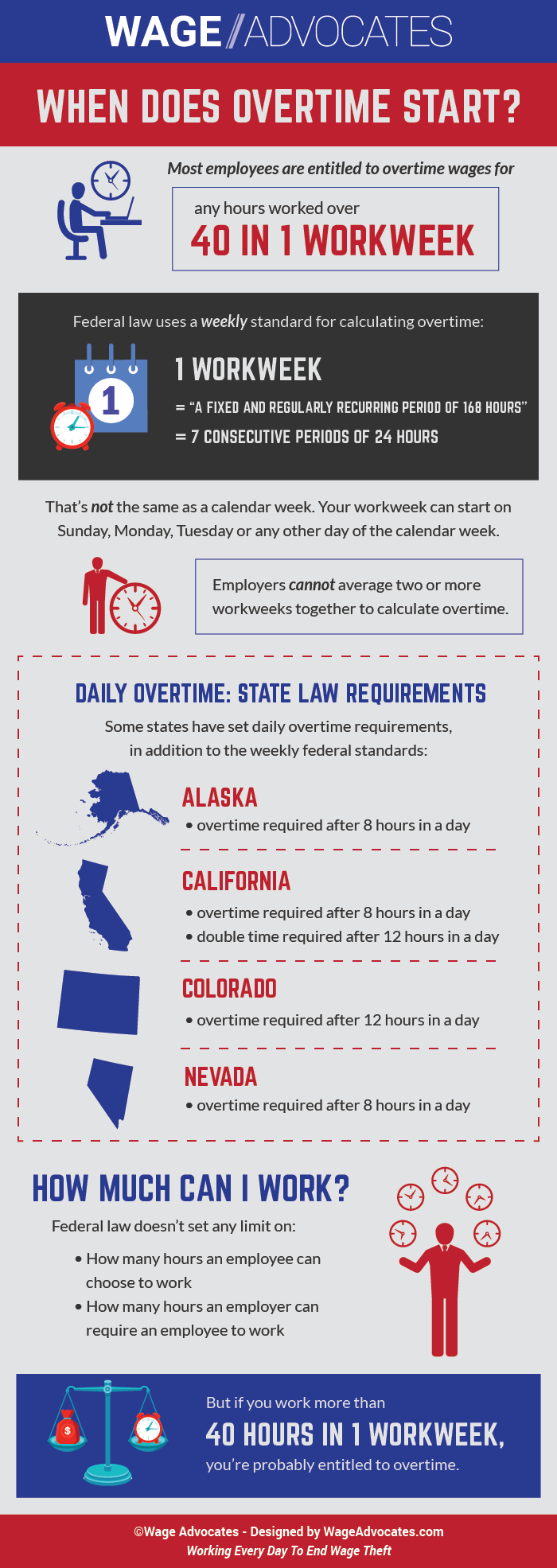

The overtime calculator uses the following formulae. Under federal law the Fair Labor Standards Act overtime compensation generally must be paid to covered employees eg employees who are not subject to an exemption from the overtime protections at a rate of at least 15 times their regular rate of pay for hours worked in excess of 40 per workweek. 1616 x 05 808 overtime is usually time and a half so to find out what time and a half is use the new hourly rate and multiply by 05 then add that to the base pay for the hours they worked overtime.

OP HOP n where OP is the overtime pay and n. The basic overtime formula is Hourly Rate Overtime Multiplier Number of Overtime Hours worked in a particular week. The overtime calculator uses the following formulae.

The remaining formula stays the same. Free Unbiased Reviews Top Picks. While calculating the additional pay for the night shift a night shift bonus is added to the basic pay.

Overtime Calculator Usage Instructions Enter your normal houlry rate how many hours hou work each pay period your overtime multiplier overtime hours worked and tax rate to figure out what your overtime hourly rate is and what your paycheck will be after income taxes are deducted. Someone whose job is in medicine law optometry architecture dentistry engineering accounting teaching art and science and does not involve manual labor. Ad In a few easy steps you can create your own paystubs and have them sent to your email.

Ad Compare This Years Top 5 Free Payroll Software. Overtime can be entered separately. A person who earns more than twice the state minimum wage for full-time employment.

Additional wages Basic Pay of the employee 200. 10 x 40 hours 400 base pay 10 x 15 15 overtime rate of pay 15 x 6 overtime hours 90 overtime pay 400 90 490 total pay Calculating overtime for multiple pay rates. 10 regular rate of pay x 5 x 10 overtime hours 50.

Get 50 Off For 4 Months. For additional information on Californias overtime exemption rule we recommend visiting. Monthly Overtime If you do any overtime enter the number of hours you do each month and the rate you get.

The regular rate is calculated by dividing the total pay for. The second algorithm of this hourly wage calculator uses the following equations. Within United States employees must be paid no less than the minimum wage as specified by the Federal and the local governments.

558 x 3 overtime hours. 1616 x 05 808 overtime is usually time and a half. Where HOP stands for hourly overtime pay HRP for the hourly regular pay and m for the multiplier most typically 15.

Double the employees regular rate of pay for all hours worked in excess of 12 hours in any workday and for all hours worked in excess of eight on the seventh consecutive day of work in a workweek. Once you know this value you can calculate your total overtime pay. We use the most recent and accurate information.

Since straight-time earnings have already been calculated see Step 1 the additional amount to be calculated is one-half the regular rate of pay 10 x 5 5. Overtime Security Advisor helps determine which employees are exempt from the FLSA minimum wage and overtime pay requirements under the Part 541 overtime regulations. Calculate total compensation for week.

Create professional looking paystubs. Unless exempt employees covered by the Act must receive overtime pay for hours worked over 40 in a workweek at a rate not less than time and one-half their regular rates of pay. The FLSA requires that covered nonexempt employees in the United States be paid at least the Federal minimum wage for all hours worked and receive overtime pay at one and one-half times the employees regular rate of pay for all hours worked after 40 hours of work in a workweek.

The most prevalent wage and hour cases are misclassification cases where employees allege they were improperly classified as exempt from overtime pay requirements. Ad Limited Time Sale. Value of the top ten wage and hour settlements in 2009 which totaled 3636 million as compared to only 253 million in 2008.

Enter the number of hours you work each week excluding any overtime. Overtime Calculator Advisor computes the amount of overtime pay due in a sample pay period based on information from the user. This workers total pay due including the overtime premium can be calculated as follows.

See Offer Details Now. - A Annual salary HW LHD 52 weeks in a year - B Monthly salary A 12 - C Weekly salary HW LHD What is minimum wage. Wage and Hour Law Overtime Overtime Calculations Overtime Calculations The following calculation examples assume the employee is non-exempt from overtime requirements of the Colorado Overtime and Minimum Pay Standards Order COMPS Order 38.

Some states have. Overtime Calculation For Piece Workers. The Hourly Wage Tax Calculator uses tax information from.

There are however a number of exemptions from the overtime law. There is no limit in the Act on the number of hours employees aged 16 and older may work in any workweek. Calculator Rates Weekly Work Info Amount Hourly Rate.

This is to be calculated per hour for the day shift.

Overtime Pay Calculators

Gross Wages With Overtime Boom Cards Digital Task Cards Consumer Math Task Cards Digital Task Cards

Overtime Calculator

How To Calculate Overtime Pay A Short Guide Timecamp

Overtime Pay Calculators

How To Calculate Overtime Pay Youtube

Sample Employment Contract Nanny Contract Template Contract Jobs Contract Template

Fact Sheet 54 The Health Care Industry And Calculating Overtime Pay U S Department Of Labor

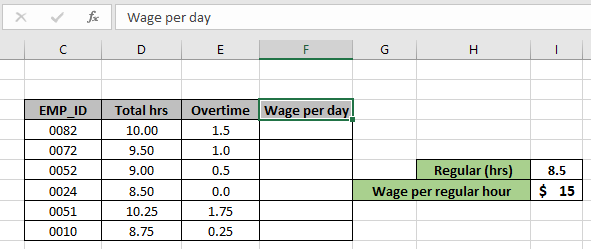

Excel Formula Basic Overtime Calculation Formula

Overtime Calculator Workest

Overtime Calculation Formula In Excel Youtube

Overtime Pay Laws Every Small Business Owner Must Know

When Does Overtime Start Wage Hour Violation Lawsuit

Calculate Overtime Amount Using Excel Formula

Calculate Overtime In Excel Google Sheets Automate Excel

Overtime Pay Calculators

Free Printable Employment Contract Sample Form Generic Sample In Overtime Agreement Template 10 Prof Nanny Contract Template Contract Jobs Contract Template